Automated invoice reminders for relationship-led businesses

Solido generates and sends personalised, invoice reminders in your business' own voice, based on your rules.

CleanTech Solutions (AUST)

Total

A$7,800.05

Amount Due

A$0.00

Amount Paid

A$7,800.05

Email Sent

1

30% less DSO

Consistent follow-up can reduce DSO by up to 30%

20 hrs +

Save 20+ hours per week on AR admin

30-day

30-day free trial

How Solido works for your business

Automated reminders on your terms

You set the rules - how many days before or after the due date, what time of day, which days of the week. Solido sends the emails automatically, but the logic is entirely yours.

Emails that come from you

Reminders are sent from your Microsoft 365 or Google Workspace account, not a generic system address. Clients can reply directly, and the conversation stays in your inbox.

Always in sync with Xero

Invoices and contacts sync automatically from your accounting software. When a client pays, Solido picks up the status change and stops sending reminders for that invoice.

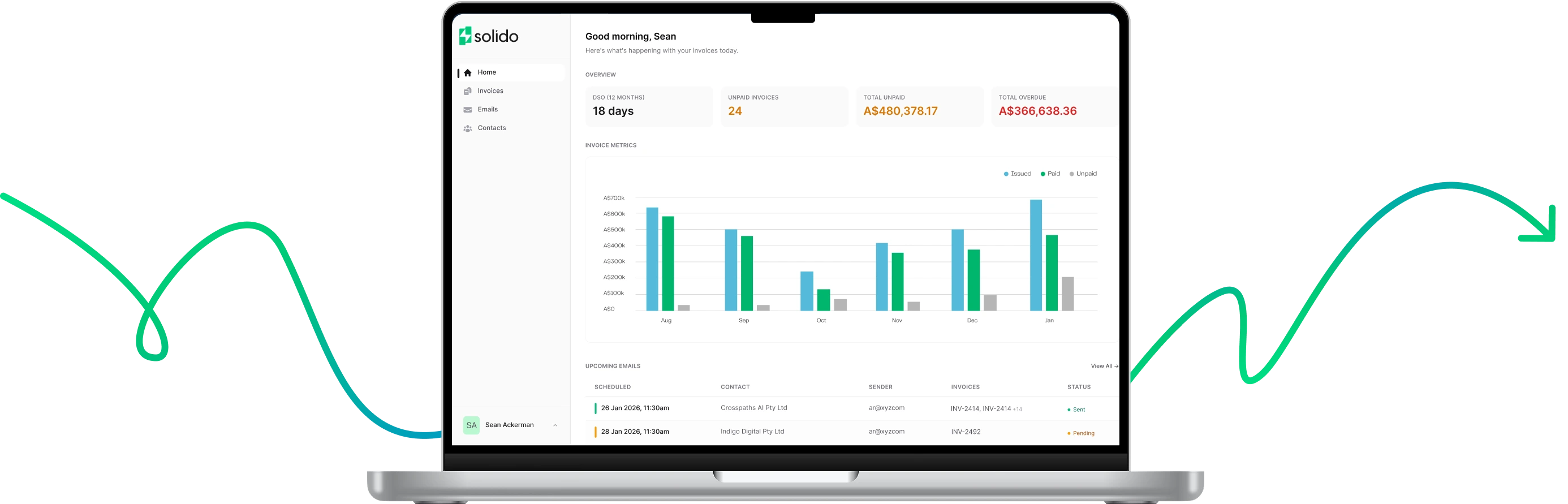

Visibility into what's happening

The dashboard shows your unpaid and overdue totals, upcoming scheduled emails, and recent activity. You can see exactly what's been sent and what's coming up.

Used by consulting firms, agencies, and professional services teams across Australia and New Zealand

"We wanted to automate reminders but were worried about how it would come across to clients. Solido gave us the control we needed to do it in a way that felt right for our business."

Darren Cook

CEO, Adaca

What's included

Dashboard & Analytics

See unpaid invoices, overdue amounts, and DSO trends in one place

Automated Reminders

Set rules for when reminders go out - Solido handles the rest

Manual Emails

Send one-off emails when you want a more personal approach

Contact Management

Control who receives reminders and who doesn't

AI-Generated Emails

Emails are composed based on the rules you set for each reminder stage

Microsoft & Google Integration

Send emails from your own mailbox

Team Collaboration

Invite team members and connect multiple mailboxes

Multi-Workspace

Manage multiple businesses from one account

Getting Started Takes About 10 Minutes

Step 1: Connect

Link your Xero account. Your invoices and contacts will sync automatically.

Step 2: Configure

Set up your reminder rules - when to send, how often, and from which mailbox.

Step 3: Monitor

Solido sends reminders on your schedule. You can check in from the dashboard, make adjustments, or step in manually whenever you need to.